www.chase.com – Auto Loan Status Check For Chase

Check The Auto Loan Status Of Chase

JPMorgan Chase has its headquarter in New York City. The bank is a provider of multinational banking services. It has total assets of $2.534 trillion. The company was founded in 2004 and it works under its parent organization, JPMorgan Chase. Chase also has some subsidiaries, Merchant Customer Exchange, Chase Paymentech and so on.

Chase.com/LoanStatus is operated by J.P. Morgan Securities LLC. You have to note the application ID would have been sent to the email address used by the applicant at the time of making an application for a loan. If you check the status of a loan it will take less than one minute and requires an Internet connection.

Auto loan rates

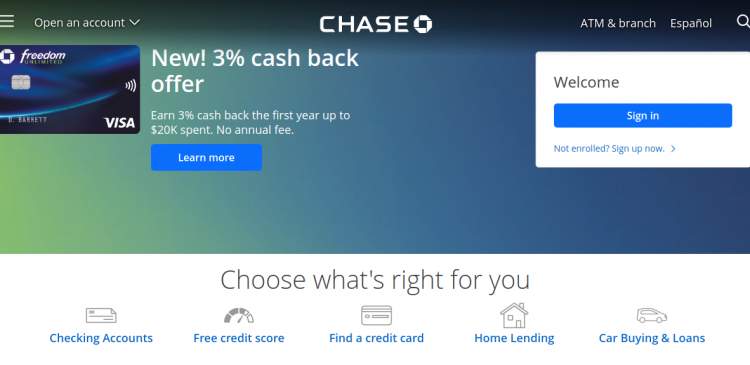

To check the auto loan rates of Chase you must venture to www.chase.com. Here at the left side click on the menu image, and here you have to scroll down. Here click on the 5th option, ‘Car buying & loans’. On the directed page scroll down and click on ‘Auto loan rates’ and you will get a box where you have to choose if your car is new or used, then type

-

Current year

-

State

-

Choose the car type

-

Select the estimated credit rating

-

Choose the amount of loan and click on ‘Get info’.

-

This way you will get to know about the interest rates easily.

Check the application status

To check the auto loan rates of Chase you must venture to www.chase.com. Here at the left side click on the menu image, and here you have to scroll down. Here click on the 5th option, ‘Car buying & loans’. You will be directed to the auto loans page and here click on ‘Auto loans’ and scroll down and you will find the option of ‘Application status’.

Here you will be instructed the way you can check the status which is upon submission of the closing of the loan and if you have left the application incomplete then you must complete and save it to check the same.

Notes on Chase auto loans

-

Every co-applicants are allowed

-

For this applicants have to register to be a Chase account holder in order to apply

-

If you are an applicant you may have to give personal financial details to include net worth and monthly salary

-

Chase bank will never guarantee a loan

-

The loans will be based on income and credit rating

-

Chase bank will not charge a fee for paying an auto loan off early

-

If you want to apply you have to give their phone number, email address, and mailing address at the time of application

If you have any query about Chase.com/LoansStatus you can call the customer service agent at 1-800-935-9935.

To pay the auto loan you have to make an online account and then log in to it to make payment for the auto loan.

Sign up for Chase auto loan

-

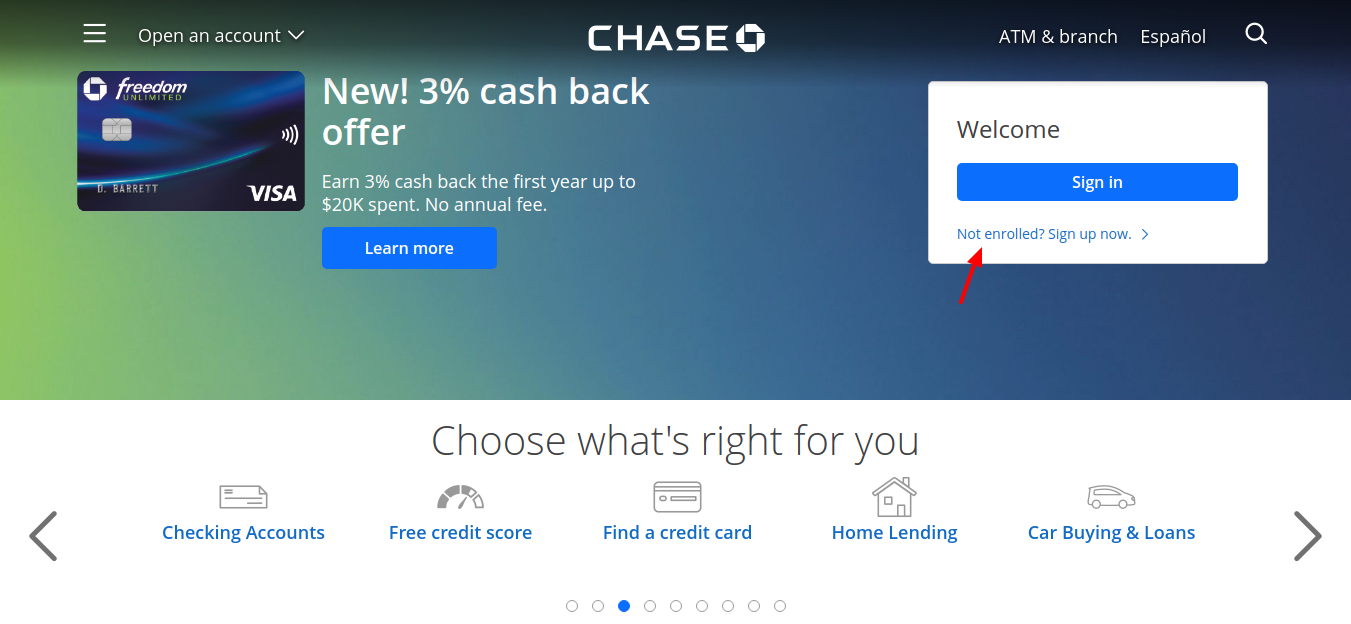

To avail, this part visit www.chase.com

-

On the landing page at the right side you will get the log in box in white, click on ‘Not enrolled? Sign up now’.

-

Here choose your account, if personal then type your

Here choose your account, if personal then type your -

Account, card or application number

-

Your social security number

-

Create a username and hit on ‘Next’.

Following the later details you will be signed up with the account, and now you can log in to your account to avail the online payment option.

Logging in to your account

-

To log in visit www.chase.com

-

Here at the right side in the login box enter your username and the confirmed password and then clicking on ‘Sign in’ you will be logged in to your account.

Forgot username or password

If you have lost your username or password of Chase auto loan then you have to visit www.chase.com . Here on the landing page go to the log in box and click on ‘Forgot username/password?’. On the directed page enter your social security number, choose the account type, choose Chase commercial loan and enter a loan account number, customer ID number then click on ‘Next’. Following the prompts, you will get back all the necessary details.

Also Read : How To Open First Midwest Bank Account Online

Benefits of Chase online account

-

Get to pay loan online

-

Manage your account

-

Get account alerts

Contact details

To contact Chase bank for auto loans, you can call on the toll-free number- 1-800-336-6675.

Reference :