www.aceflareaccount.com/activate – Guide to Activate Ace Flare Bank Card Online

Complete guide to Activate your Ace Flare Bank Debit card:

Ace Flare card make it easy for you to get cash when you need it most. ACE Cash Express has opened its doors to clients seeking financial ACE Flare Account Customer Service since 1968. Here you can apply for a payday loan, installment loan, or prepaid card. Their physical locations offer check cashing, money transfer / MoneyGram, and ATM services. ACE cash express help consumers find alternatives to traditional banking relationships by providing them with convenient and instant access to financial services.

So, if you want to enjoy all the benefits of this card then go through the complete article to activate your debit card easily.

Features and benefits of Ace Flare Debit card:

Before activating your Ace Flare card, you have to check out the benefits of the Ace Flare Debit card. here we have described the amazing benefits of this card.

- Through Direct deposit, you can get your payroll or government benefits are in your ACE Flare account and helps you when you need them.

- You can activate many features of the ACE Flare account with the help of a Qualified Direct Deposit.

- You get paid up to 2 days faster with a direct deposit using the Ace Flare card.

- You can get details on account transactions and more with anytime notifications. Regarding your purchase history, balance, etc. you can send and receive text messages.

- In your ACE Flare account, you can earn 0.07% APY.

- At a participating ACE Cash Express location, you can withdraw up to $ 400 per day in cash for free.

- At ACE Flare Account Login, you need a qualified direct deposit.

Benefits of Mobile banking:

- You can receive SMS or emails to stay up-to-date with details of transactions, deposits, and more through mobile banking.

- You can check your balance at any time.

- You can easily send money to friends and family.

- Through mobile banking you can Use your unique Flash-Pay ID to quickly transfer funds to other ACE Flare account members.

- Easily you can receive refund of money.

- You can Activate benefits in the app or online account center to receive redemption rewards that will be credited to your account for qualifying purchases.

- You can check your security deposit.

- You will need to just take a photo of your check and add the funds to your ACE Flare account.

- You can transfer your money to bank.

- You can Link other bank accounts or your PayPal account and easily transfer money to your ACE Flare Account Login.

Rates:

- Retail Application Processing Fee: $3.00

- Minimum deposit needed to open Account: $0.0

- Monthly Fee: $9.95

- Interest-Bearing: yes

- ATM Cash Withdrawal Fee – Domestic: $2.50

- ATM Cash Withdrawal Fee – International: $4.95

- Balance Inquiry Fee – ATM Domestic: $1.00

- Balance Inquiry Fee – ATM International: $1.00

- Overdraft Fee: $20.0

- Maximum Number of Overdraft Fees per Calendar Month: 5

- Foreign Transaction Fee: $3.00

- Stop Payment Fee – ACH Debit or $0.00 Preauthorized Payment Transactions: $0.0

- Decline Fee – ACH Debit or Preauthorized Payment Transactions: $0.0

- Custom Card Fee: $4.95

- Additional Card Fee: $3.95

- Replacement Card Fee: $3.95

- Over The Counter Cash Withdrawal Fee at a financial institution: $2.50

- Balance Inquiry Fee – Telephone Customer Service Agent: $0.50

- Account-to-Account Transfer Fee –Customer Service Agent: $4.95

- Account-to-Account Transfer Fee –Online: $0.0

Mandatory requirements for creating an online account:

- You must have a regular source of income to ensure that you can repay the loan. Having a job is not mandatory.

- You must live in the state in which you have applied for a loan.

- You have to be at least 18 years old.

- You must not be a debtor in bankruptcy proceedings or voluntarily apply for a bankruptcy exemption.

- You must not be a regular or reserve member of the Army, Navy, Marine Corps, Air Force, or Coast Guard who is on active duty under a Call or Command that does not specify 30 days or less, or a member of. dependent is the Bundeswehr on active duty.

- You have to provide a valid social security number or individual tax identification number.

- You have to provide a valid email address.

- You must have a checking or savings account for at least a month.

- In case of California residents, they must have had a checking account for at least one month.

- If a review of the application information is required. So It should be available by phone.

Create online Ace Flare Bank account:

If you want to activate your Ace Flare Bank debit card online first you need an online account through which you can access online banking.

- First you have to open your ACE FlareAccount.com online.

- Then click on the Apply Now option.

- Then the the Ace Flare website will appear.

- There you have to click Get Started option.

- You have to provide your personal information, including your name, postal address, email, and phone number.

- Also, provide your social security number and date of birth there.

- Then you just need to review and accept the electronic signature and account agreement disclosure.

- Then you have to choose your card and click Next button.

- Finally, you have to follow the instructions to review and submit your application.

- After completing the process, you will receive a registration confirmation from FlareAccount.com.

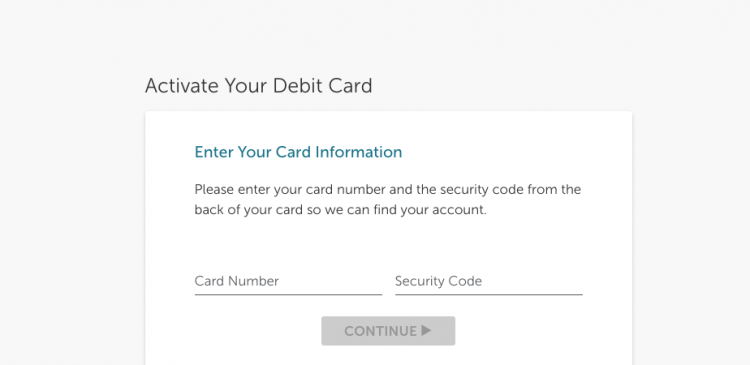

Activate Ace Flare Bank Card through Online Method:

You will need a smart device, high-speed Internet, your card account number, and other card details. For activating your Ace Flare Card, you have to follow the below-mentioned guidelines.

- First, you have to switch on your computer or laptop.

- Then you have to launch your regular browser.

- Then you have to click on this link www.aceflareaccount.com/activate.

- After that, you will be directed to the card activation page.

- You have to provide the Card number and Security Code in the required fields,

- Then click on Continue.

- You have to provide your login information in the required fields.

- Finally, you have to follow the on-screen instructions and give in all the details asked for completing the activation process.

Activate Ace flare card via visiting a retail store:

If you don’t want to use the activation link there is also an alternative mode of activation which you can do via visiting a nearby branch.

- After receiving your Card, you will need to visit the nearest retail shop.

- There you have to activate the card by taking help from the cashier.

- You have to make sure of before heading to a retailer is that it is a participating retailer.

- You can make purchases and keep track of the transactions by registering yourself for an Ace Flare account after activating your card.

- You can visit the Ace Flare website to complete the process.

Activate Ace Flare Bank Debit card using phone:

If you don’t have an online banking account or don’t use a mobile phone then you have to wait for the PIN to arrive. You have to sure that the PIN arrives in the mail separately.

- First, you have to call 1-866-753-6355 from your phone and speak to an authorized representative.

- You have to tell the person that you want to activate your card. the person will verify your details.

- After successful verification, you can activate your debit card using the PIN.

- You can do a deposit or withdraw some amount to activate your card at any Ace Flare Bank ATM. Your PIN details will be required.

- Remit the details and activate your card.

Ace Flare Bank debit card PIN setup:

Online mode:

- First, you have to log in to your Ace Flare Bank account www.aceflareaccount.com/account/login

- In the left-hand menu select the Change PIN option.

- Then the change PIN screen will appear.

- You have to type your old PIN code and your new PIN code twice for confirmation.

- Click on the submit button.

Using automated phone service:

- You have to dial the number given on the back of your card.

- You have to Press 1 – I have an existing card option.

- You have to again Press 1 – Activate, obtain balance, review transactions, or other cardholder information.

- Then you have to enter the card number, last 4 of SSN, and CVV.

- Then you have to say ‘Change PIN’.

- Then a new prompt will appear to enter a 4-digit PIN (you do not need to enter prior PIN), and then you have to re-enter the new PIN to validate.

Ace Flare Bank debit card log in:

Go to the following instructions for logging in to your account.

- First you have to visit the official login page of Ace Flare debit card www.aceflareaccount.com/account/login

- You have to provide the user name and password in the given field.

- Then tap on the login button.

- You can access your online account easily.

Recover password for Ace Flare Bank debit card online account:

If you forgot your account password then don’t worry, here are just a few steps to recover those and you can again get access to your online account.

- Visit the login page of Ace Flare account www.aceflareaccount.com/account/login

- Click on the Forgot User Name link.

- Then provide the card account number in the given space.

- Then click on the continue button.

- Follow the instructions and reset your user name.

- In case you forgot your password then click on forgot password option.

- Provide the required details like user id, email, social security number etc. and verify your account.

- An email will be sent to your verified mail id with a link to reset your password.

- Reset your new password within the given time.

- Get access to your online account.

Ace Flare Bank debit card balance check:

You can check your balance anytime with only these few simple steps.

- First you have to log in to your Ace Flare Bank account www.aceflareaccount.com/account/login

- On the top right-hand corner of the screen, your balance will appear.

- You can also check your balance without a transaction fee by calling the number on the back of your card if you do not have any internet access.

Ace Flare Bank debit card cash withdrawal:

- You can withdraw cash visiting any Ace Flare Bank or All point ATM at additional cost to you and surcharge-free. You can also check the Ace Flare Card mobile app for a list of surcharge-free ATMs.

- You don’t need to pay fee for in-network ATM withdrawals.

- You will also be charged a fee by the ATM operator even if you do not complete a transaction.

- You will have to pay for your first 4 ATM withdrawals per month, which includes both ATM withdrawals (out-of-network) and International ATM withdrawals.

- You can do up to 10 transactions per day with a total daily withdrawal limit of $1,025.

- You can also withdraw cash after visiting the nearby branch.

Money transfer from Ace Flare debit card to personal account:

- First, you need to log in to your Ace Flare Bank account www.aceflareaccount.com/account/login

- Then visit the Manage Money menu.

- There you have to select Card to Bank Transfer option.

- You have to follow the instructions to input account information to which funds are being sent.

- You have to review your account information for accuracy to avoid any delays.

Also Read: Manage your Heb Prepaid Card Account

Bill Pay Setup for Ace Flare debit card:

- You have to log in to your online Ace Flare Bank account www.aceflareaccount.com/account/login

- Visit the top navigation bar and click, the Manage Money option.

- Then in the left-hand menu click on the bill pay option.

- Then the bill pay window will appear.

- In the “Pay someone new” field at the top of the screen, you have to enter the person or business name you’d like to pay.

- Then you have to click on the ‘Add’ option.

- Then the “Add a Person or Business to Pay” window will appear.

- Then you have to add the Account Number, Address, City, State, Zip Code, and Phone Number of the person or business you wish to pay.

- Then click on the continue button.

- Then a confirmation page will open.

- Then you have to Click “Go to Make Payments”.

- Then you will return to the Make Payments home screen and will be able to see your new payee listed.

- You will be able to make one-off payments to this payee.

Autopay setup:

- Click on the Autopay option present under the payee’s name.

- Then you have to choose “Pay automatically at regular intervals” on the next screen.

- If you have more than one account, then choose the funding account.

- You have to enter a memo.

- Then type in the amount you wish to pay at the regular interval.

- Then you have to choose the frequency of your payment.

- You have to choose the start date.

- Then choose how long you would like the payments to continue.

- Then click on “Save Changes”.

- After that a confirmation screen will appear.

Ace Flare card Transaction history check:

You can easily check your transaction history of Ace Flare debit card following these simple steps.

- First you need to sign in to your account www.aceflareaccount.com/account/login

- Then from the menu on the left, you have to select “Paper Transaction History”.

- Then you have to select the year and month you would like to view.

- Then You’ll have the option to select “Print Friendly View of Page”.

- Print the page or save it to your personal device.

How to Fix PIN Lock issue:

You don’t have to worry if you lock your PIN. You have to fix the issue through the following steps mentioned below.

- You can call the number on the back of your Ace Flare Card and reset your PIN using the automated system.

- If you make too many attempts using the wrong PIN then your card may be locked.

Customer service:

You can contact their 24/7 customer service through the details given below.

You have to visit the page www.flareaccount.com/contact

Then type your name email and issue in the given space.

Then submit the form.

You can also call their customer service by dialing (866) 753-6355

They will help you as soon as possible.

Reference:

www.aceflareaccount.com/activate

www.aceflareaccount.com/account/login