www.claimit.ca.gov – Betty T. Yee California State Controller Unclaimed Property Search

Get Access To Betty T. Yee California State Controller For Unclaimed Property Search

Betty T. Yee California State Controller is the state controller that runs the website for the revenue and money related problems. It provides services like enhancing the government’s accountability. It also controls the boards and the commissions.

You can also get on to the career opportunities page to get the careers that you are deserving for. You can also search your unclaimed property from this website along with property tax postponement services as well. You can also get the language access complaint process.

You will have to go to an official website of the California State Government for the unclaimed property search. Here, you can check the details in this article, and get more information.

Claim an unclaimed property Betty T. Yee California State Controller

For this visit, www.claimit.ca.gov

On the page, scroll down a bit and at the left side, click on, ‘Search for unclaimed property’.

-

In the next page at the middle type,

-

Last Name:

-

First Name:

-

Middle Initial:

-

City:

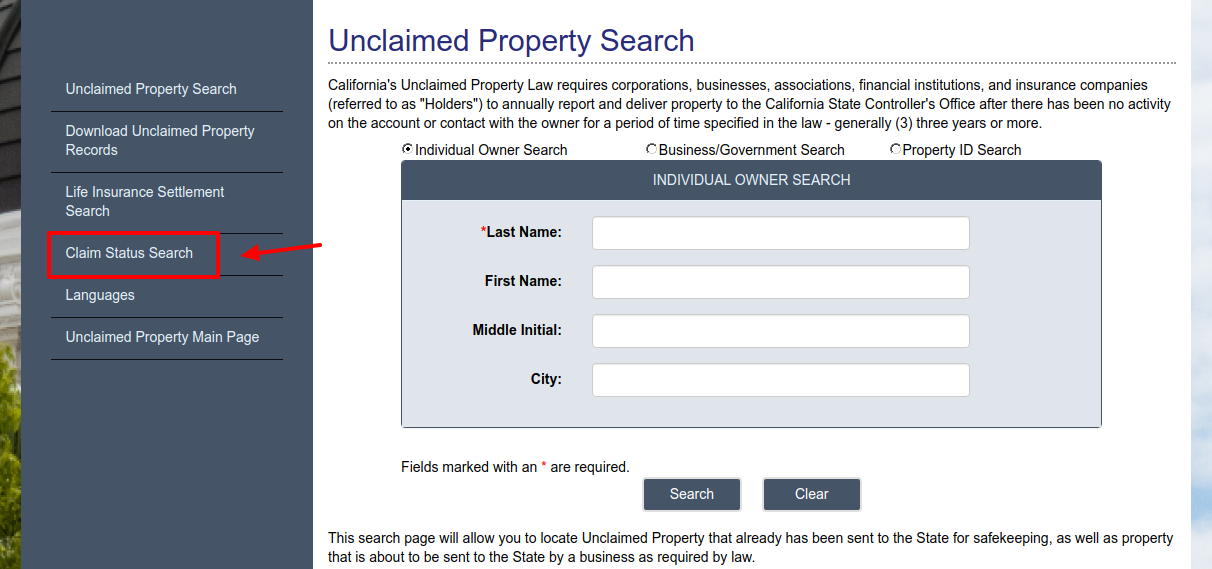

Check the Betty T. Yee California State Controller search status

For this go to, www.claimit.ca.gov

On the page, scroll down a bit and at the left side, click on, ‘Search for unclaimed property’.

-

On the middle left side you will get a list, here, click on, the fourth option, ‘Claim status search’.

-

On the directed page scroll down a bit, and you will get a box. Here, type,

-

The claim ID

-

Then click on, ‘Search’.

-

You can also search by social security number.

-

Here, enter,

-

SSN/Tax ID/FEIN:

-

Confirm SSN/Tax ID/FEIN:

-

Then click on, ‘Search’.

Note: On the left side list you can choose your preferred language too. In the main page, you can also download the unclaimed property forms and other documents. To claim the property you can watch the videos posted on the page.

Additional details on Betty T. Yee California State Controller

-

Unclaimed Property is generally defined as any financial asset that has been left inactive by the owner for a period of time specified in the law, generally three years. The California Unclaimed Property Law does NOT include real estate. Unused gift certificates are also generally excluded from unclaimed property and are not sent to the State as unclaimed property. The most common types of Unclaimed Property are:

-

Bank accounts and safe deposit box contents

-

Stocks, mutual funds, bonds, and dividends

-

Uncashed cashier’s checks and money orders

-

Certificates of deposit

-

Matured or terminated insurance policies

-

Estates

-

Mineral interests and royalty payments

-

Trust funds and escrow accounts

-

California’s Unclaimed Property Law requires corporations, businesses, associations, financial institutions, and insurance companies (referred to as “Holders”) to annually report and deliver property to the State Controller’s Office after there has been no activity on the account or contact with the owner for a period of time specified in the law—generally three (3) years. Often, contact is lost when the owner forgets that the account exists, or moves and does not leave a forwarding address, or the forwarding order expires. In some cases, the owner dies and the heirs have no knowledge of the property.

There are several steps you can take to prevent your property from being turned over to the State:

-

Cash your dividend, interest, or refund checks promptly.

-

Keep accurate records of all financial accounts and review them at least once a year.

-

Maintain annual activity on accounts.

-

Provide your financial institutions with a primary contact, secondary contact, or beneficiary contact name.

-

Remain aware of your accounts.

-

Respond promptly to notifications from the business or the State Controller’s Office that your property may be transferred to the state if you do not contact the business within the stated time period.

-

The contents of your safe deposit box will be reported to the State Controller’s Office after three years if you have had no contact with the bank. After the contents have been turned over to the State Controller’s Office, they may be sold at auction 18 months after the due date for reporting the safe deposit box to the State Controller’s Office. (California Code of Civil Procedure Section 1563(a))

-

Net proceeds from the sale will be credited to an account in your name, less any bank liens, and will be paid when a valid claim is submitted. Properties relating to California’s military history will be held in trust at the California State Military Museum. Property with no apparent commercial value will be held for at least seven years after which it may be destroyed. (California Code of Civil Procedure Section 1565)

-

The State Controller’s Office has not sold at auction any properties since May 22, 2006, and has not destroyed any properties with no apparent commercial value since May 16, 2006.

-

Your investment accounts will be turned over to the State Controller’s Office, which is required by law to sell the securities, no sooner than 18 months and no later than 20 months, after the due date for reporting the securities to the State Controller’s Office. Net proceeds will be credited to an account in your name until such time a valid claim is submitted.

-

Unclaimed Property Law was passed to protect consumers. It prevents businesses with unclaimed property from keeping your money and using it as business income. The law provides California citizens a single source, the State Controller’s Office, to check for unclaimed property that may be reported by businesses from around the nation and enables the State to return property, or the net proceeds from any legally required sale of the property, to its rightful owner or their heirs.

-

All ‘Holders’ (corporations, businesses, associations, financial institutions, and insurance companies) of Unclaimed Property are required by law to make attempts to contact owners before reporting their property to the State Controller’s Office. Holders are required to send a notice to the owner’s last known address informing the owner that the account will be transferred to the State Controller’s Office for safekeeping if the owner does not contact them and let them know what they want done with their property.

-

For Unclaimed Property received between 1990 – 2007, the State Controller’s Office, by law, was permitted to notify only those owners whose address reported by the business was different from the owner’s address on file with the Franchise Tax Board. This restriction effectively prohibited the State Controller’s Office from contacting approximately 80% of owners. The State Controller’s Office is now going back through this property and notifying, without restriction, all owners for whom we can find a current address through the Franchise Tax Board.

-

Starting in 2008, the State Controller’s Office has been able to send notices to all owners whose property is about to be transferred to the State. These notices are sent out before the property is to be transferred which gives owners an opportunity to retrieve their property directly from the business holding the property.

-

Businesses reporting unclaimed property only report the name of the owner. They do not have the ability to determine whether the owner is deceased and who their rightful heirs might be. We recommend you search for property for the names of anyone who might have named you as an heir. If you are an heir you may file a claim for the property.

-

Owners or heirs can search for their property directly on the California State Controller’s Office Web site and file a claim for free. Possible ownership may be indicated if the information you provide results in a match. It is important to remember that many people have the same name, so the property listed may not necessarily be yours. We will be able to determine your ownership with the documentation that you provide when you send in the claim.

-

You can start your search for Unclaimed Property held by other states through the National Association of Unclaimed Property Administrators (NAUPA) website.

-

You can start your search for Unclaimed Property held by other California Government agencies through their websites.

-

California State Teachers’ Retirement System (CalSTRS) Examples of unclaimed property held by CalSTRS include uncashed and returned checks, unclaimed survivor benefits, or dormant accounts.

-

Locate any statement or original document from that account and present it to the business or financial institution for them to research.

-

You must file a claim with the State Controller’s Office. Start your search to find your property and create your claim. Your claim may be eligible to be filed electronically. For more information about electronic filing, see About Electronic Claim Filing. If your claim is not eligible to be filed electronically, or you prefer to file a paper claim, you will be directed to print and mail in your claim form along with proof of ownership. For paper claim filing instructions, please go to Claim Instructions and Forms. If you have reason to believe that your property has been sent to the State Controller’s Office for safekeeping, but you did not find your property listed on our website, please contact the State Controller’s Office, Unclaimed Property Division at (800) 992-4647 for assistance.

-

The State Controller’s Office processes Unclaimed Property claims free of charge.

-

Owners or heirs can claim their property directly from us without any service charges or fees.

-

Investigators (sometimes referred to as Asset Locators or Heir Finders) may charge you a fee. It is against the law for investigators to charge a fee greater than 10% of the value of the property that is returned to you. (California Code of Civil Procedure, Section 1582) There are no fee restrictions for County Probated Estate claims.

-

The California Unclaimed Property Law was amended in August 2003 to eliminate the payment of interest.

-

The property owner or heir is entitled to the benefits from any corporate actions—such as dividends, mergers, and stock splits—taken by the issuing company while the stock is being held by the State Controller’s Office for safekeeping.

-

In order to donate unclaimed property to the State of California, the apparent owner must file a claim for the property and prove entitlement. At the time of filing a claim, a written designation of a fund or appropriation to receive the donation may be made. If specific designation to a particular fund or appropriation is not made, the law requires the donation be credited to the State School Fund.

-

California Government Code Sections 926.8 and 12419, allows the Franchise Tax Board to intercept payments from the state lottery, tax refunds and unclaimed property funds for debts owed to a state, city or county agencies. The State Controller’s Office intercepts only the amount owed and the intercept will apply even if you are in an installment agreement with said agency. If you have questions or disagree with the intercept, you may call the agency listed on the intercept notice that is mailed to you. The State Controller’s Office Unclaimed Property has no information on the reason for the intercept.

-

Before a property is transferred to the State, the State Controller’s Office sends a notice to all property owners with property valued at $50 or more informing them that they have property that will be transferred to the State unless they contact the business by a certain date. The State Controller’s notice includes the name of the business, the contact information, the type of property and the amount. In the interest of protecting the privacy of potential property owners and giving them an opportunity to claim their property from the holder, we will no longer disclose the specific amount reported by the holder until it is turned over to the state.

-

It is critical that you contact the business by the deadline stated in the notice to prevent the property from being transferred to the State.

-

Note: The business contact information is provided by the business and occasionally changes after the State Controller’s Office sends the notice to property owners. An updated business contact list is available for that have changed their information.

-

After your property is transferred, you may claim it from the State at no charge. There is no time limit on claiming your property once it has been sent to the State.

-

Investigators are not allowed to contract with a property owner to help the owner recover unclaimed property once a business has notified the State Controller’s Office that the property will be transferred to the state for safekeeping. A property owner may reactivate the account or recover the property free of charge from the business.

-

There is no time limit for filing a claim. You can file a claim at any time after the Unclaimed Property has been transferred to the State Controller’s Office.

-

If your property search is successful, a highlighted Property ID number will appear on the Search Results page next to your name and address. Click on the Property ID number link. This link will take you to the Property Details page. On that page, you will find a printable copy of the Claim Affirmation Form. Be sure to follow all of the instructions on the form.

-

Claim Electronically: If your claim is eligible, you will be given the option to file electronically after you have entered the requested information for your claim. For more information see About Electronic Claim Filing.

-

Mail Claim Form: If your claim is not eligible to be filed electronically, or you prefer to file a paper claim, you will be directed to print and mail in your claim form. To avoid delays in processing your claim, you MUST send us copies of the required documents as outlined in the filing instructions to determine rightful ownership. Claims cannot be filed via email or fax.

Also Read : Mango Money Prepaid Card Account Login Guide

Customer care

To get help from the department, you will get different division contact details.

Executive Office

Sacramento

300 Capitol Mall, Suite 1850

Sacramento, California 95814

Phone (916) 445-2636

Fax (916) 322-4404

Los Angeles

888 South Figueroa Street, Suite 2050

Los Angeles, CA 90017

Phone (213) 833-6010

Fax (213) 833-6011

Administration and Disbursements Division

P.O. Box 942850

Sacramento, California 94250-0001

Phone (916) 323-8314

Fax (916) 327-0597

Disbursements

Phone (916) 445-7789

Fax (916) 445-5759

Audits Division

Claim Audits Sacramento

3301 C Street, Suite 705

Sacramento, California 95816

Phone (916) 445-3060

Fax (916) 327-4694

Field Audits Sacramento

P.O. Box 942850

Sacramento, California 94250-0001

Phone (916) 324-8907

Fax (916) 327-0832

Field Audits Los Angeles

901 Corporate Center Drive, Suite 200

Monterey Park, California 91754-7619

Phone (323) 981-6802

Fax (323) 981-6811

Information Systems Division

300 Capitol Mall, Suite 634

Sacramento, California 95814

Phone (916) 322-3030

Fax (916) 323-4969

Local Government Programs and Services Division

3301 C Street, Suite 740

Sacramento, California 95816

Phone (916) 445-8717

Fax (916) 323-6527

Personnel/Payroll Services Division

300 Capitol Mall, 10th Floor

Sacramento, California 95814

Phone (916) 445-5361

Fax (916) 322-6493

State Accounting and Reporting Division

3301 C Street, Suite 753

Sacramento, California 95816

Phone (916) 323-3258

Fax (916) 323-4807

Unclaimed Property Division

10600 White Rock Road, Suite 141

Rancho Cordova, California 95670

Phone (916) 464-0641

Fax (916) 464-6222

Legal Office

State Controller’s Office

300 Capitol Mall, Suite 1850

Sacramento, California 95814.

Reference :