capitalone.com/activate – Activationg guide for Capital One Card Online

Activate your Capital One Card Online:

Are you searching for a credit card that suits you according to your needs? Then you can choose from a wide range of credit cards offered by Capital One Financial Corporation, which is an American bank holding company that specializes in auto loans, banking, and savings accounts founded in the year 1994. It has its headquarters in McLean, Virginia but it has been primarily operating in the United States and is also reputed for being a technology-focused bank. The areas they serve are the United States, United Kingdom, and Canada.

Before getting into the overall benefits of the capital one cards, we will first take a look at the wide range of cards offered by Capital One Bank, and a small gist of their properties, so that you can have an idea of choosing and learning from the range of cards.

Capital One SavorOne Cash Rewards Credit Card – this card gives you an intro bonus of $200 that is only for once after you spend a total of $500 on your purchases within the first 3 months of opening your account. There is no annual fee for this card and comes with a regular APR of 14.99%-24.99%.

You need to have a credit score of 670-850 to apply for this card.

Capital One Venture X Rewards Credit Card – This card will give you 100,000 points on spending $10000 on the first six months of your account opening. It comes with an annual fee of $395 with a regular APR if 16.99%-23.99%.

You need to have a credit score of 740-850 to apply for this card.

Capital One Venture Rewards Credit Card – if you are spending a total of $3000 on purchases within the 3 months of your account opening, then you will receive 60,000 points which is a one-time bonus, which is equal to $600 for your travel. It needs to be maintained annually for $95 with a regular APR of 15.99%-23.99%.

It requires a credit score of 670-850.

Capital One VentureOne Rewards Credit Card – on the spending $500 within the first 3 months of account opening, you will receive a bonus of 20,000 miles for once which is equal to $200 in your travel. This card needs no fee for annual maintenance and has a regular APR of 14.99%-24.99%.

You need to have a good credit score of 670-850 to apply for this card.

Capital One Platinum Credit Card – this card comes with no intro bonus, and thus it is quite obvious it need not have any annual maintenance. It comes with an APR of 26.99%.

The credit required is 580-740.

Capital One Platinum Secured Credit Card – it comes with a no intro bonus and no annual maintenance. It has an APR of 26.99%.

Capital One Spark Miles for Business – it gives you a one-time bonus of 50,000 miles which is equal to $500 in your travels on the spending of $4500 on your purchases within the first 3 months of opening your account. You don’t need to pay any maintenance fee for the first year, but it needs regular maintenance of $95 after that. It has an APR of 20.99%.

It requires a credit score of 670-850 for applying for this card.

Capital One QuicksilverOne Cash Rewards Credit Card – it does not give any intro bonus and comes with annual maintenance of $39. It has a regular APR of 26.99%.

It requires a credit score of 580-740.

Capital One SavorOne Student Cash Rewards Credit Card – this card does not offer with any intro bonus and needs no annual maintenance. It has a regular APR of 26.99%.

It requires a credit of 580-740 to apply for this card.

Capital One Quicksilver Secured Cash Rewards Credit Card – it does not gives any into bonus and do not require any fee for annual maintenance. It has a regular APR of 26.99%.

Capital One Spark Cash Plus – this card offers you cash bonus of upto $1000, once $500 when you are spending $5000 in the first three months, and the other time again you will be rewarded $500 if you spend a total of $50,000 in the first 6 months of account opening. It has an annual maintenance of $150 and there is no AP for this card.

You need to have a credit score of 670-850 to apply for this card.

Capital One Quicksilver Student Cash Rewards Credit Card – there is no introduction bonus offered by this card and needs no annual maintenance. It has a regular APR of 26.99%.

It requires a credit score of 580-740 to apply for this card.

Journey Students Rewards from Capital One – you are to get $60 during the 12 monthly streaming services, only if you pay your credit bills on time. It does not require nay annual fee for the maintenance and has a regular APR of 26.99%.

It needs a credit score of 580-740 to apply for the card.

Let us take a look at the services offered by Capital One Bank:

- They offer you credit cards and banking that are for business and personal accounts.

- They provide business loans, auto loan and refinancing.

- They provide you with the commercial banking solutions.

Also Read: Sears Rewards Credit Card Login

Benefits of Capital One Bank:

- It gives you a broad range of rewards cards which are designed according to the spending habits of the customers.

- The cards offer you the help to achieve your financial goals.

- You don’t need to pay any foreign transaction fee that saves you 3% to 5%.

Who is regarded to own this card:

- The ones who love traveling – will be able to earn rewards on purchases, that will build their dream towards their destination.

- The people who love shopping – you can get bonus on certain cards on good spending of your money within the given period of time.

- The food lovers – you are to get any cashback and rewards on your favourite restaurants, so this is a good opportunity for the foodies.

- The ones who want to build their credit score.

- The business owners who want to earn valuable rewards and build their credit score form the bottom line.

Activation of Capital One Credit Card:

- Through online mode

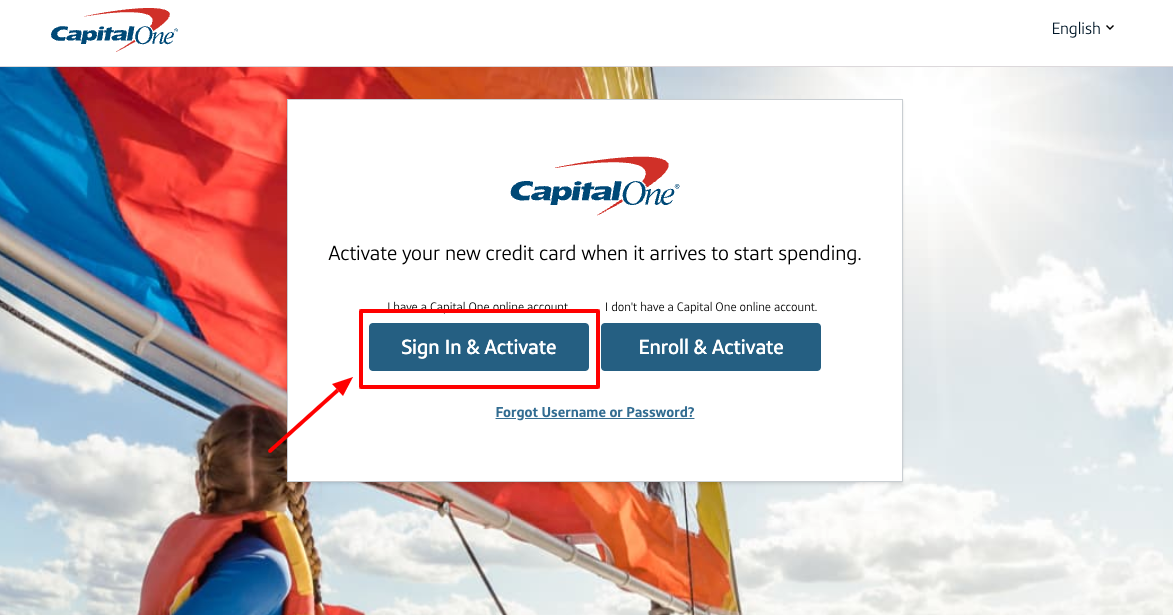

- The first thing you need to do is link your credit card account to the existing one. You need to browse the activation site from your laptop or mobile or may directly use the link capitalone.com/activate.

- After you are done you need to log in to your Capital One account using your Username and Password. If you are devoid of any account, you need to create one.

- After you have successfully logged in, you will be prompted to enter the CVV code present at the back of your card and the card number.

- Once you are done filling in the credentials of your card as asked, there will be an automatic updating of your account and you Capital One card will be activated.

- Using Mobile App – if you don’t want to follow the steps for the activation procedure through online mode, then you can opt for activating your card through mobile app. You need to download the Capital One mobile app which is compatible with Android and iOS. Then you need to create your profile and click on the Account Settings and then on Activate Credit Card.

- Through Phone – there are certain numbers for the activation of Capital One Credit Card as follows –

- General Customer Service from the United States – 1-877-383-4802.

- General Customer Service from Canada – 1-800-481-3239.

- Personal Credit Cards – 1-800-Capital

- Small Business Credit Cards – 1-800-867-0904.

These are toll-free numbers on which you can call to activate your cards. Once you call, you will be connected to the representative and there you need to give all the credentials of your card as asked in order to be activated.

As now seen that there are different cards offered by them which can be chosen and used according to their ease, and if you have decided of owning a Capital One card, then we have to see on how you can apply for one.

The first and most important thing is that you need to see if you are prequalified, as most of the cards require a good score for applying. You can go through a 60-second pre-qualification check offered by Capital One Bank. This tool will help you by matching a card that matches your credit score and you need to answer a few basic questions. The main thing is this won’t impact your credit score.

When you will be applying for the credit card, you need to give your full name, social security number, date of birth, home address, estimated gross annual income, checking or savings account information. After applying, you will be notified by the bank whether you have been approved or not by mail within 7-10 days. After being approved, you can activate the card.

The payment procedure of your Capital One Credit Card bill:

There are many options you can opt for the bill-

- By Phone – You can call them on the number given at the back of your card, and give the credentials when asked for the payment to be successful.

- Through online mode – you need to login to you online account and click on the option of Make a Payment.

- Using the Mobile App – login to your profile and then tap on the option Make a Payment.

- By mail – you will be able to send a check or money order on the address Capital One / Attn: Payment Processing / PO Box 71083 / Charlotte, NC 28272-1083.

When you are mailing, you need to keep in mind that it might take some time, so you need to send the mail keeping in hand a few days before the due date.

Some Frequently Asked Questions (FAQs):

What are the information required to apply for the Capital One Credit Card?

Ans. You have to give your Full name, social security number, date of birth, physical address, the gross annual income, checking or savings account information.

When will I be receiving my new credit card?

Ans. Once your card is approved, you will receive the card, credit information, welcome materials within the 7-10 business days. If you have applied for the Secured MasterCard and is approved, then first you have to pay the deposit in full before the shipping of the card, and then you will get the card in 7-10 business days.

What shall I do if my card gets stolen?

Ans. If you want to report it online, then that will be the fastest way to do it, and doing so will allow them to deactivate the card so that it might not be used by any other person. If this process is not for you, then you can also call on the number 1-800-955-7070.

Conclusions:

This article covers almost all the points regarding the services offered by Capital One Bank. Not only that, you will also get a gist of the different credit cards available by the bank, the activation procedure of the card, as well the applying process. While reading the whole article, of you face any problem, you can always have the option of contacting them on the number 1-800-227-4825, this number is for the existing customers only. For online banking support, you need to call on the number 1-804-934-2001.

Reference: