www.53.com – Appply Your Fifth Third Bank TRIO Card Online

Fifth Third Bank TRIO Credit Card Review

About Fifth Third Bank:

Firth Third Bank is a financial service company in the United States. Headquarter of this bank is located in Cincinnati, Ohio. Fifth Third Bancorp is the parent company to the Fifth Third Bank. Within the Midwestern United States, it is considered one of the largest consumer banks. There are around 1,164 branches and approximately 2,469 ATMs throughout Ohio, Kentucky, Indiana, Tennessee, West Virginia, Georgia, and North Carolina.

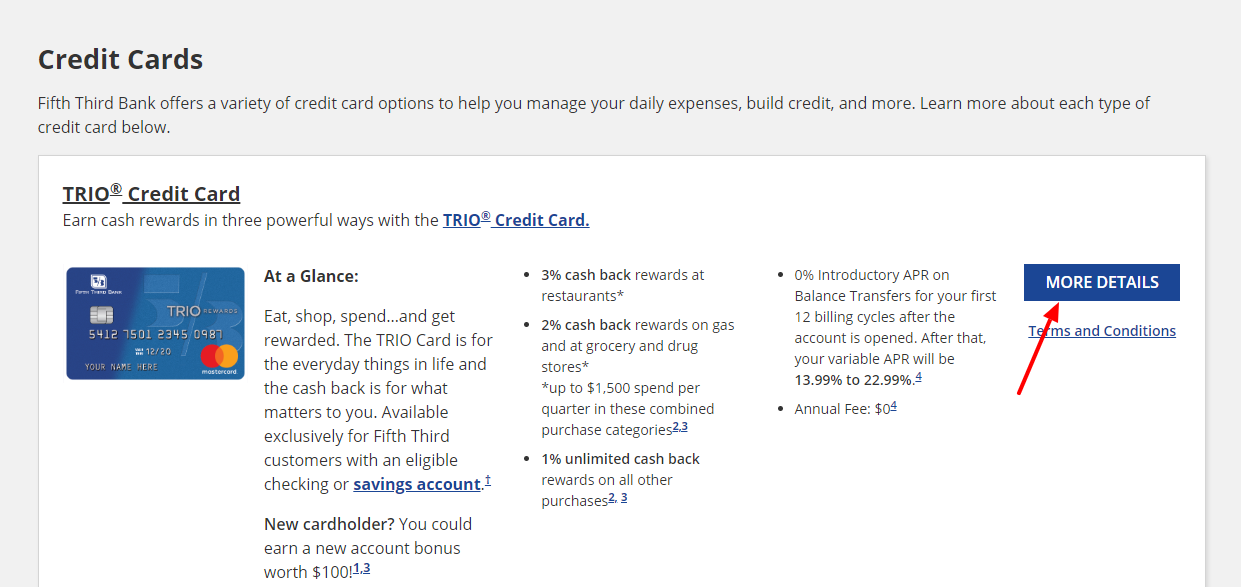

TRIO Credit Card Overview:

If you are looking for a new low maintenance card, through which you can earn direct cashback, then the TRIO Credit Card would be a perfect choice. It is a greater choice for those customers who love dining out and pay for gas and groceries with their cards.

Its standard earn rates are somewhat low for the industry. Using this card, you can earn cash back on gas, groceries, and dining out makes up for it.

One of the best features of this card is, it comes with the 12 months of 0% intro APR for balance transfers, but not for the purchase.

This card is mainly targeted to users with good credit. The standard industry rates ranging from 15.49% to 24.49%. The APR on balance transfers or purchases, can vary, depend on your creditworthiness. This card does include fees for transfer balance and advances.

With some of the travel benefits from Mastercard thrown into the mix, as well as zero foreign transaction fees, the TRIO card is a great blend of perks and reliability, which makes this card a solid cash back card.

TRIO Credit Card Rewards and Benefits:

This card might have lacks some of the bells and whistles which some of the cashback card offers, the TRIO card still offers some helpful value-added benefits for their customers. This card offers the travel benefits, along with the tiered earn rate, which allows you to quickly rack up the cash rewards:

Tiered Cash Back:

One of the best beneficial attributes of this card is how easily the customer card earns cash back. But this card is designed for the customers, who use their card heavily. Users can earn cash 3% cashback at dining out at restaurants, 2% cash back at grocery and drug stores, and on all the other purchases, you will receive a flat cashback of 1%.

The first two cash backs are only available for the total spending of up to $1,500 for combined purchase categories each quarter.

Shopping and Security Benefits:

When you make any purchase using the credit card, you will be glad to know that, your goods remain protected. The TRIO card offers the low key but some essential parks, which make the shopping less trance full. The customers can rest assured they are obtaining the best price on any purchase using this card for the company’s price protection guarantee.

Coverage for Travelers:

With the TRIO card, customers will get the Mastercard’s comprehensive travel benefits. For anyone who spends time at airports or abroad, that includes some key perks which will make your travel experience significantly smoother.

TRIO Credit Card Rates and Fees:

Interest Rates:

- APR for Purchases: For your purchases, your APR will be 13.99% to 22.99%. The amount will depend on your creditworthiness.

- APR for Balance Transfer: For the first 12 billing cycle, your intro APR for cash advance will be 0%. Then, depending on creditworthiness, your APR will be between $13.99% to 22.99%.

- APR for Cash Advances: Cash advance APR for this card is 24.99%.

Fees:

- Annual Fee: There will be no annual fee for TRIO Credit Card.

- Balance Transfer Fee: For each balance transfer, you have to pay 4% of the amount or at least $5.

- Cash Advance Fee: For each cash advance, you will be charged 5% of the amount or at least $10.

- Late Payment Fee: For the late payment fee, you will be charged up to $40.

Pros and Cons of TRIO Credit Card:

Pros:

- You can earn 3% cashback on dining and 2% back on the gas station and other grocery purchases.

- As the sign-up bonus, you will be rewarded with $100.

- The best thing about this is, it does not charge any annual fees.

Cons:

- You can only earn a bonus cashback on your first spending of $1,500.

- For the $100 sign up bonus, you have to spend the large amount of $1,000 within the 90 days of account opening.

How to Apply for TRIO Credit Card:

In order to apply for the TIRO Credit Card, you need to follow these instructions below:

- First, you have to visit this link www.53.com.

- On the homepage, you have to click on the Credit Cards option.

- Then, from the credit card list, you have to select the TRIO Credit Card option.

- There, you need to follow the on-screen instructions to complete the application process.

Also Read : Activate Your Barclays Card Online

Fifth Third Bank Customer Service:

If you face any problem, then contact the Fifth Third Bank at:

Phone:

1-800-972-3030

Mon-Fri: 8 a.m. to 6 p.m. EST

Sat: 10 a.m. to 4 p.m. EST

Sun: Closed

Conclusion

Fifth Third Bank TRIO Credit Card is an overall good credit card, that offers a wide variety of benefits and perks. You don’t have to pay any annual fees for TRIO Credit Card. For any other information, you can simply with the Firth Third Bank Customer Service.

Reference Link: