www.capitalone.com – How To Apply Capital One Spark Cash Card Online

Capital One Spark Cash Back Business Card Review:

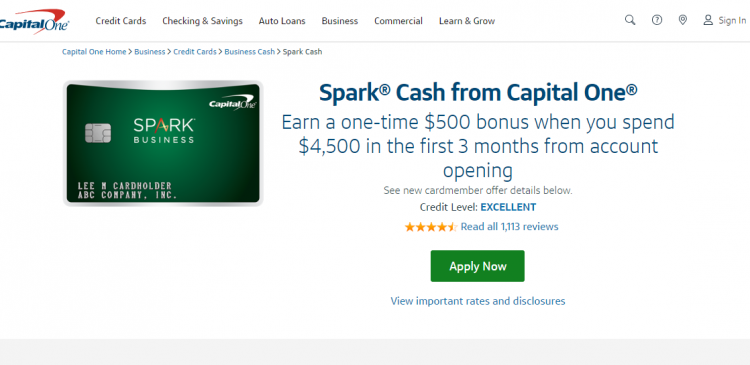

About Capital One Spark Business Card

In the Spark family, you will get the other five different credit cards, including the two-cashback card that covers in this review. Both of these cards are designed for excellent credit scores. These two cards are Capital One Spark Cash for Business and Capital One Spark Cash Select for Business. Both of these cards are the cashback card, so, there is nothing to worry about the spending categories. So, every purchase you make sure the card, you will get the rewards.

The Spark Cash has an annual fee but also charges the higher cashback rate. But if you spend over $19,000 every year, then this card will be very promising for you. Every year, if you spend that much amount, then you can go for the Spark cash Select to earn more cashback.

Both of these cards report to the major business credit bureaus regularly. So, using both of these cards, you can build or rebuild your credit cards.

Rates and Fees of Spark Cash Back Business Cards:

Capital One Spark Cash for Business

Interest Rates:

- APR for Purchase: 20.90%.

- APR for Cash Advances: 26.99%.

Fees:

- Annual Fee: $0 for the first year and then $95.

- Transfer Fee: None.

- Cash Advances: 3% of the amount of $10 minimum.

- Late Payment: Up to $39.

Capital One Spark Cash Select for Business:

Interest Rates:

- APR for Purchase: For the first 9 months, intro APR will be 0% on the purchase. Then, your APR will be 13.99%, 19.99% or 23.99%, depending on your creditworthiness.

- APR for Cash Advances: For each cash advance, you will be charged 26.99%.

- APR for Transfers: Depending on your creditworthiness, you will be charged 13.99%, 19.99%, or 23.99%.

Fees:

- Annual Fee: None.

- Transfer Fee: None.

- Late Payment Fee: For the late payment fees, you will be charged up to $39.

Pros and Cons of Spark Cash Back Business Cards:

Pros:

- These cards are very cheap to use. The Spark Cash Select card does not charge any annual fee, while the Spark Cash charges $95. If you spend a little as $4,750 every year, then you can easily offset that fee.

- With both these cards, you will get a pretty good welcome bonus in the first year.

- These two Spark Cards are at the Visa Signature level credit cards. Compared to most of the credit cards, it comes with the upgraded benefits.

- You will get several employee cards at no cost.

- Capital One credit cards usually report to the three major credit bureaus. That means it will gradually improve your business credit.

Cons:

- Compare to some of the other business credit cards, you won’t get a ton of cash back earning.

Also Read : Activate Your Destiny MasterCard Online

The Rewards

In Spark Cash, you will get 2% of cashback everywhere you shop. This card comes with the largest welcome bonus of $500. Within the first 3 months of your account opening, you have to spend a minimum of $4,500, you will get the bonus.

In the Spark Cash Select, you will get 1.2% cash back on every purchase, along with the welcome bonus of $200. Within the first 3 months from the day of your account opening, you have to make a spend of a minimum $3,000, to earn the $200 bonus.

Apply for Spark Cash Back Business:

Spark Cash: www.capitalone.com/small-business/credit-cards/spark-cash

Spark Cash Free: www.capitalone.com/small-business/credit-cards/spark-cash-select

Capital One Customer Support:

Capital One Customer Support:

Customer Service: 1-800-CAPITAL (1-800-227-4825)

Outside the US: 1-804-934-2001

Fraud Protection: 1-800-427-9428 or 1-800-239-7054

Mail:

Capital One

Attn: General Correspondence

P.O. Box 30285

Salt Lake City, UT 84130-0287

Conclusion

Capital One Spark Cash Back cards are one of the best cashback cards available in the market. In this card, you can earn some exciting rewards compare to other credit cards.

Reference Link:

www.capitalone.com/small-business/credit-cards/spark-cash/

www.capitalone.com/small-business/credit-cards/spark-cash-select/