www.citicards.com – How To Manage Your Citi Bank Credit Card Account

Access your Citi Bank Credit Cards Online

Overview of Citibank

Citibank is the consumer division of Citigroup. Is was founded on June 16, 1812. The headquarter is located in New York City, New York. As the city bank of New York, it became the First National City Bank of New York. It has over 2,500 branches in 19 countries. In the United States, it has 723 branches.

Citibank Credit Card

If you are a Citi Credit cardholder, then you wanted to know about managing your Citi Credit Card account online. Or, if don’t have Citi credit card, then you can also apply for the card, by following these articles. You can manage your credit card online. You can also check your credit card balance, pay bills, access cards statement, and you can check the transaction history.

There are many types of credit cards that Citibank offers. They are:

Thank You Credit Cards

In this section there are four Credit Cards:

- Citi Reward+ Card:

The Citi Reward+ Card is the only card that automatically rounds up to the 10 points on your every purchase. From purchasing a cup of coffee, you can earn 10 points. With this card, you can earn 10% points back to the first 100,000 per year.

Purchase and Balance Transfer Rate:

For the first 15 months, they will charge 0% intro APR on your purchase and balance transfer. But after that, they will charge 15.49% to 25.49%, based on your creditworthiness. And the balance transfer will charge you $5 or 3% of the amount you transfer.

Annual Fee:

No Annual Fee charges on Citi Reward+ Card.

- Citi Premier Card:

You can use the Citi Premier Card on your everyday purchase. Form your purchase you can earn points. Then you can spend those points on travel, entertainment, restaurant and many more.

Purchase Rate:

17.99% to 25.99% variable APR based on your Creditworthiness.

Annual Fee:

Citi Premier Card charges $95 every year.

- Citi Prestige Card:

You can earn points very faster with the Citi Prestige Card. You will earn 5 points on every dollar you spend on air travel and restaurant purchase.

Purchase Rate:

18.99% to 25.99 veritable APR based on your creditworthiness.

Annual Fee:

Citi Prestige Card charges $95 every year.

- Citi Rewards+ Student Card:

With Citi Rewards+ Student Card, you can earn ThankYou points on your every purchase.

Purchase Rate:

For the first 7 months, it charges 0% intro APR on purchase. After that, the variable APR will be 16.49% to 26.49%, based on your creditworthiness.

Cash Back Credit Cards:

In this section there is one credit card:

- Citi Double Cash Card:

Citi Double Cash Card is the most popular cashback card. With this card, you can earn 2% or 1% on your every purchase.

Purchase and Balance Transfer Rate:

It will charge 15.99% to 25.99% on your purchase. APR is based on your creditworthiness. For the first 18 months, it will charge 0% intro APR on balance transactions. After that, it will charge 5% or 3% on each balance transfer.

Annual Fee:

No annual fee charges for this card.

Simplicity Credit Card:

In this section there is one credit card:

- Citi Simplicity Card:

Citi Simplicity credit card does not charge any late fine or any annual fees. They offer the lowest introductory APR.

Purchase Rate:

For the first 12 months, it will charge 0% into APR. After that, they will charge up to 16.74 to 26.74% based on your creditworthiness.

Balance Transfer Rate:

For the first 21 months, it will charge 0% intro APR. After that, it will charge up to 16.74 to 26.74% based on your creditworthiness. Balance transfer will cost $5 on each transaction.

Annual Fee:

Citi Simplicity Card does not charge any annual fees.

Citi/AAdvantage Credit Cards:

In this section there are four credit cards are available:

- Citi/AAdvantage Platinum Select World Elite Mastercard:

Save your money with Citi/AAdvantage Platinum Select World Elite Mastercard. It does not charge any fees on the foreign transaction. You can earn air miles plus travel benefits.

Purchase and Balance Transfer Rate:

17.99% – 25.99% variable APR based on your creditworthiness.

Annual Fee:

Fee waived for the first 12 months. Then it will charge $99 each month.

- CitiBusiness / AAdvantage Platinum Select World Mastercard:

Save your money with Citi/AAdvantage Platinum Select World Elite Mastercard. It does not charge any fees on the foreign transaction. You can earn air miles plus travel benefits. Including first checked bag free.

Purchase Rate:

17.4% to 25.74% variable based on creditworthiness.

Annual Fee:

Fee waived for the first 12 months. Then it will charge $99 each month.

- American Airlines AAdvantage MileUp Card:

Earn airline miles using American Airlines AAdvantage MileUp Card. You can earn AAdvantage miles on every dollar you spend on the purchase.

Purchase and Balance Transfer Rate:

17.99% – 25.99% variable APR based on your creditworthiness.

Annual Fee:

It does not charge any annual fee.

- Citi / AAdvantage Executive World Elite Mastercard:

Upgrade to elite travel benefits including priority check-in and boarding with Citi / AAdvantage Executive World Elite Mastercard.

Purchase and Balance Transfer Rate:

17.74% – 25.74% variable APR based on your creditworthiness.

Annual Fee:

It charges $450 for each year.

Expedia Rewards

This section has one credit card:

- Expedia Rewards Card From Citi:

Earn points with the Expedia Rewards Card. You can redeem those points towards premium travel rewards, hotels, and flights.

Purchase Rate:

16.99% – 24.99% variable APR based on your creditworthiness.

Annual Fee:

It does not charge any annual fees.

AT&T Credit Cards:

- AT&T Access Card From Citi:

With AT&T Credit Card you can earn 2 ThankYou points on every $2 you spend on a purchase.

Purchase Rate:

15.99% – 24.99% variable APR based on your creditworthiness.

Annual Fee:

It does not charge any annual fees.

Secured Credit Card:

- Citi Secured Mastercard:

Build your credit history with a secured credit card.

Purchase Rate:

24.49% variable APR

Annual Fee:

It does not charge any annual fees.

Costco Credit Cards:

- Costco Anywhere Visa Card by Citi:

You will get a reward by using the Costco Anywhere Visa Card. This visa card is accepted anywhere.

Purchase Rate:

17.24% variable APR

Annual Fee:

No annual fees with your paid Costco membership.

- Costco Anywhere Visa Business Card by Citi:

You will get a reward by using the Costco Anywhere Visa Card. This visa card is accepted anywhere. Discover the Costco which is fit for your business.

Purchase Rate:

17.24% variable APR

Annual Fee:

No annual fees with your paid Costco membership.

Diamond Preferred Credit Card:

- Citi Diamond Preferred Card:

It is the low intro APR on balance transfer and purchase cards.

Purchase and Balance Transfer Rate:

The first, it charges 0% on balance transfers and purchases. After that, it charges 15.74% to 25.74%. In balance transfer it charges $5 on each transaction.

Annual Fee:

No annual fees for this credit card.

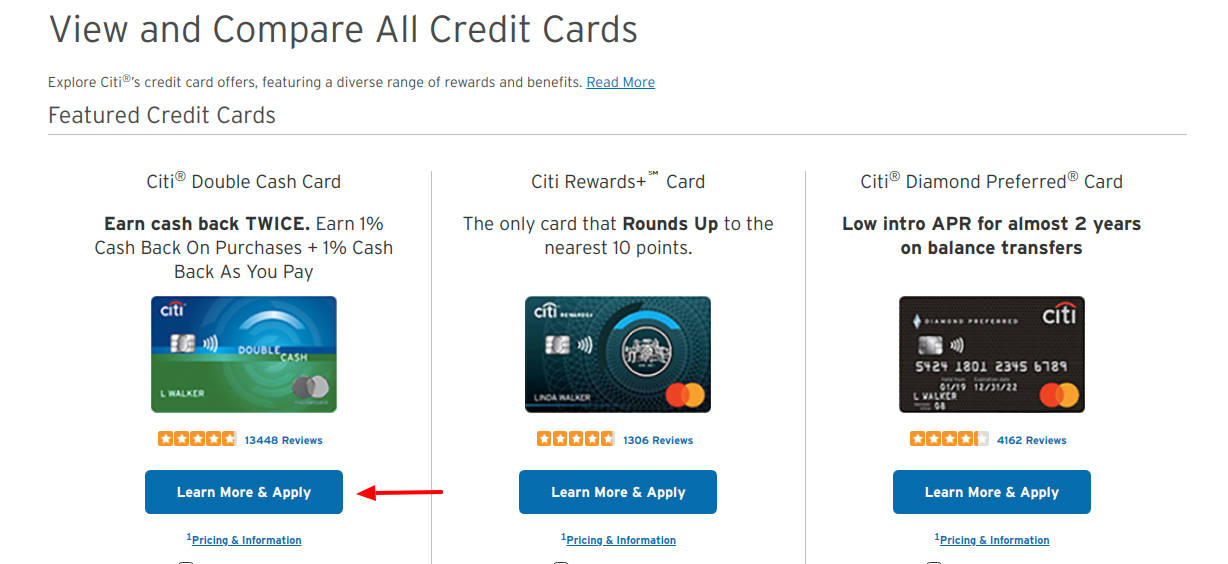

How to Apply for the Credit Card:

It is very easy to apply for the credit card. By following some very simple steps you can easily apply for the Citi Credit Card.

- First, you have to visit www.citicards.com. It will take you to the Citi website credit card page.

- Then click on View and Compare All Cards.

- Now, you can see every credit card that Citi has to offer.

- Choose any type of Gift Card you want and click on Learn More & Apply.

- On the next page click on Apply Now.

- Then enter the required information to complete the form.

- At the end click on Submit button.

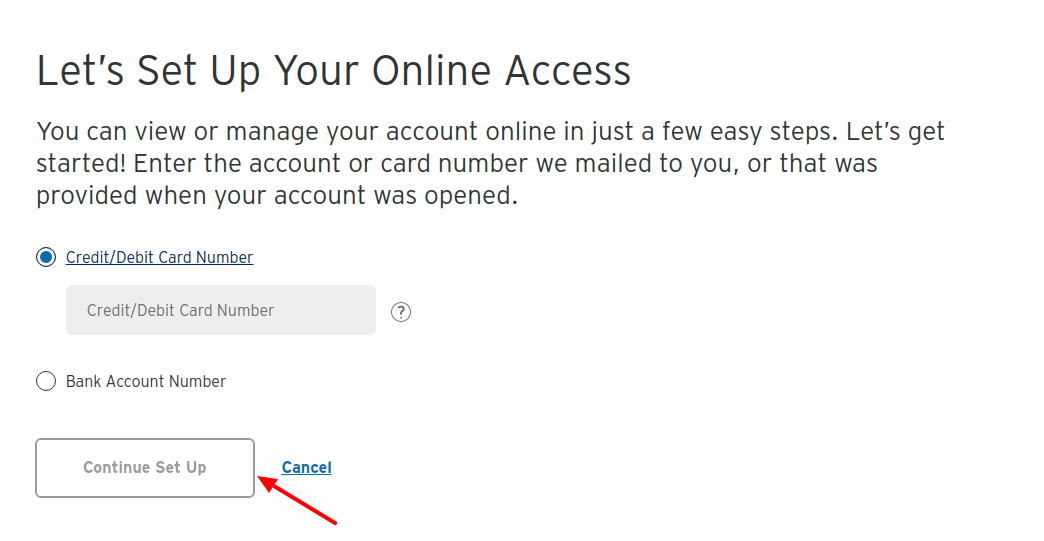

How to Register for Citi Credit Card:

You can easily register your Citi Credit Card, by following these simple steps:

- First, you have to visit this link online.citi.com/US/CBOL/sec/usereg/flow. It will take you to the registration start page.

- Enter your credit or debit card number of the given box.

- Then click on the Continue Set Up button.

- Then enter your CVV code.

- Enter your birth date.

- Then enter the last 4 digits of your Social Security Number.

- Then click on the Next button.

- Then follow the instruction to complete the process.

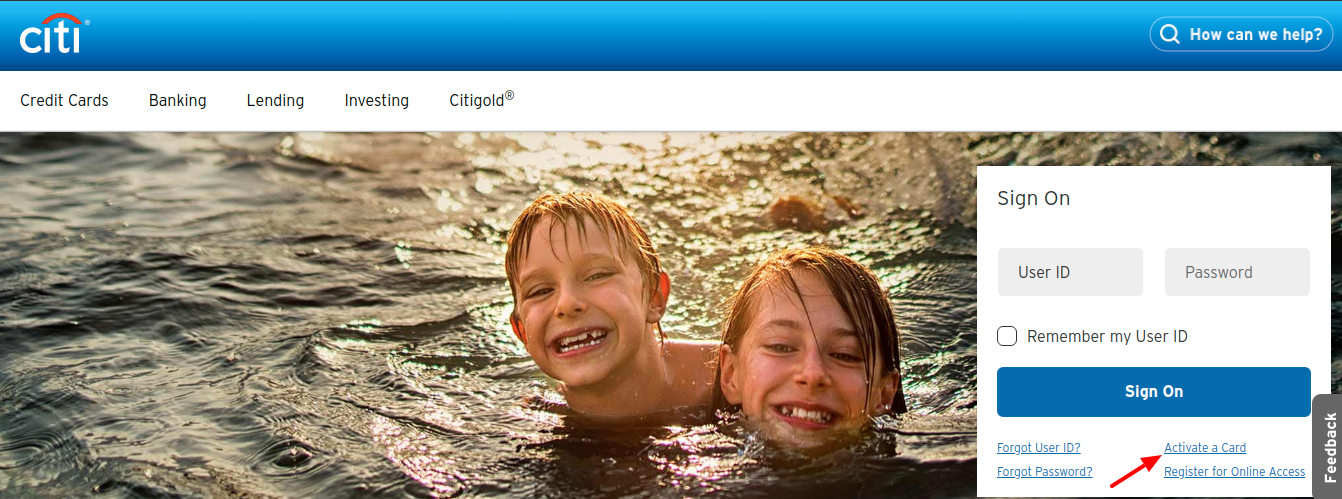

How to Login into your Citi Credit account:

It is very to login to your Citi Credit Card account. In order to log in, you need User ID and Password. Then you can easily access your Credit Card account on your computer. Follow these below steps to login:

- First, you have to visit www.citicards.com then clink on Sign On.

- There on the provided box, enter your User ID and Password.

- If you are using your personal device then tick the box, Remember My User ID.

- Then simply click on the Sign-On button.

Also Read : Login To Your Walmart Credit Card Account

How to Recover your Forgotten Password:

- First, you have to visit www.citicards.com.

- Then click on Forgot User ID and Password.

- Enter your ATM, Debit or Credit Card Number.

- Then click on the Continue button.

- Then enter your CVV code.

- Choose the type of account you are using.

- Enter your date of birth or last 4 digits of SSN ore Security Word.

- Then simply click on the Continue button.

- Then follow the instructions.

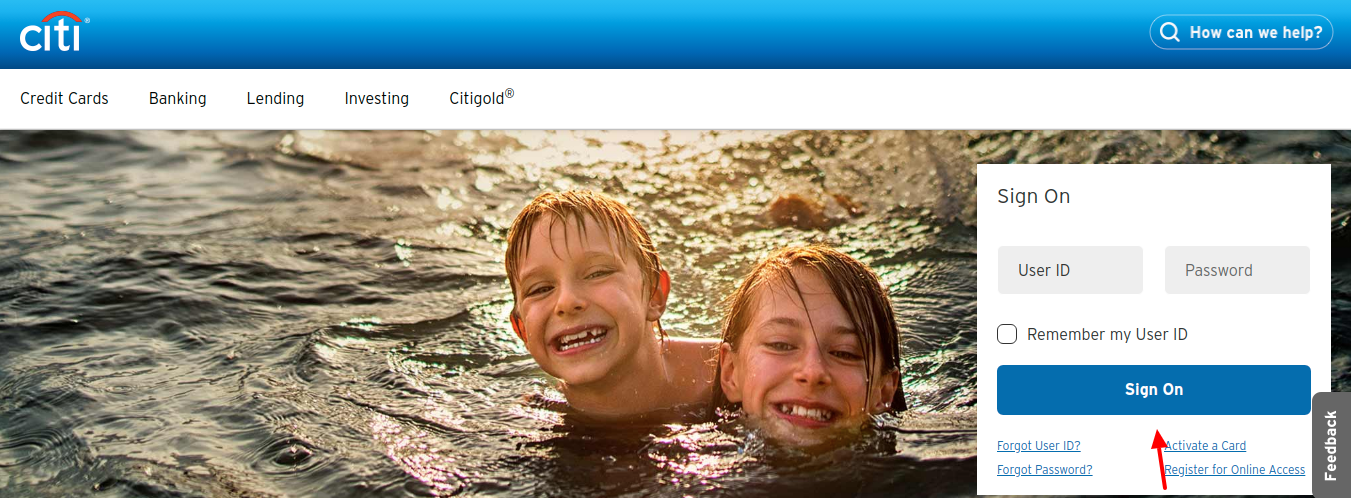

How to Activate your Citi Credit Card:

In order to activate your Citi Credit Card, you have to follow these instructions:

- First, you have to visit www.citicards.com.

- Then click on Active a Card.

- Then you have to enter your card number.

- Click on the continue button.

- Then you have to follow the instructions to complete the process.

Contact Info:

Consumer: 1-800-347-4934

Consumer TTY: 1-800-325-2865

Business: 1-866-422-3091

Business TTY: 1-800-325-2865

Lost/Stolen: 1-800-950-5114

Lost/Stolen TTY: 1-800-325-2865

Reference Link:

- Citi website (credit cards page): www.citicards.com

- Citi credit cards registration start page: online.citi.com/US/CBOL/sec/usereg/flow

- Citi credit cards activation: online.citi.com/US/CBOL/sec/secgat/flow