www.ncsecu.org – NCSECU Member Login

Login to NCSECU Member Online Account

North Carolina State Employees’ Credit Union known as NCSECU. State Employees’ Credit Union works as a state-chartered credit union. It was founded on 4th June 1937 and is headquartered in Raleigh, North Carolina, U.S.

The North Carolina State Employees Credit Union operated by the North Carolina Department of Commerce. The National Credit Union Administration of the US insured the deposits of the SECU members. NCSECU has 256 branches along with a member count of 2.1 million. NCSECU provides its services in 100 countries of North Carolina.

If you want to know what the benefits of the NCSECU membership are, what are the eligibility criteria, how to login to the NCSECU member account and all other things related to the NCSECU member’s account then, you should go through the below guide.

Why Choose NCSECU:

NCSECU provides a wide range of services and products to meet the financial requirements of its members. You can choose NCSECU as your financial partner for the below reasons.

- Advance loan for financial requirement

- You can get a mortgage loan with zero down payment

- Affordable and exiting savings reward programs

- Assist members and get free summer cash and holiday cash accounts.

- Digital online services like Mobile Payments, online bill payments, transaction alerts, etc.

- The available low-cost tax program

- Except, all the above services you can get auto loan facility, life insurance, etc.

Benefits of the NCSECU Membership Online Account:

Being an NCSECU Member you can access your account from anywhere at any time. Along with this, you can also avail of some other benefits and these benefits are.

- You can check your account balance, statement and transaction details

- You can avail the fund transfer facility between the State Employees’ Credit Union accounts

- Online bill payment with Bill pay service.

- You can set up automatic payment for any biller

- You can set up a nickname for your account

- Through the online account you can also apply for accounts and loans.

Eligibility for NCSECU Membership:

To avail the benefits of the NCSECU, you need to be its member first and for the membership you need to meet the below eligibility criteria first.

- You need to be an employee of any states of North Carolina

- If you are an employee of public boards of education then, you are eligible for the same

- North Carolina National Guard employees

- Employees of Civil Defence, Mental Health and Social Services of North Carolina are eligible for the membership.

- If any person died in his/her eligibility duration then his/her unmarried spouse are eligible for the membership

- Immediate family members of the current members

If you met one of the above-mentioned eligibility criteria then you can open your NCSECU account with $25. If your age is under 12 and you are eligible for the membership then you can open your account with just $5.

Rate and Fees of the NCSECU Online Account:

Along with the benefits, you should know about the rate and fees of the NCSECU account.

A. Deposit Rates:

1. Checking/ Money Market:

i. Share Draft:

- Opening Deposit: $0

- Rate: 0.25%

- APY: 0.25%

ii. Money Market:

- Opening Deposit: $250

- Rate: 1.00%

- APY: 1.01%

2. Share Account:

i. Share:

- Opening Deposit: $25

- Rate: 0.65%

- APY: 0.65%

ii. Z-share:

- Opening Deposit: $25

- Rate: 0.65%

- APY: 0.65%

iii. FAT CAT Share:

- Opening Deposit: $5

- Rate: 0.65%

- APY: 0.65%

iv. Summer Cash 2019/2020:

- Opening Deposit: $0

- Rate: 2.03%

- APY: 2.05%

v. Holiday Cash:

- Opening Deposit: $0

- Rate: 0.65%

- APY: 0.65%

3. Share Term Certificates:

- Duration: 6-60 months

- Opening Deposit: $250

- Rate & APY: 1.05% to 1.55%

4. IRA/CESA:

- Opening Deposit: $25

- Rate: 1.50%

- APY: 1.51%

5. Health Savings:

- Opening Deposit: $25

- Rate: 1.50%

- APY: 1.51%

B. Mortgage:

- Duration: 5 – 20 years

- Rate: 3.25% to 4.75%

- APR: 3.353% to 5.365%

C. Loans:

1. Vehicle Loans:

- Duration: 36 months to 72 months

- APR: 3.75% to 5.75%

2. Credit Card:

- Direct Pay APR: 9.25%

- Maximum APR: 18.00%

3. Salary Advance Loan: APR: 7.00% to 13.50%

4. Personal Loan:

- Duration: 6 months to 120 months

- Payroll Deduction: 5.00% to 10.75%

D. Fees:

i. Checking:

- Monthly Maintenance Fee: $1.00 to $2.00

- Service fee: $0

- Stop Payment order: $8.00

- Overdraft Transfer: $0.05

ii. Cash Points Global:

- Monthly Maintenance Fee: $ 1.00

- Stop Payment Order: $ 8.00

iii. Credit Card Late Payment fee: $ 5.00

Also Read : Login To HotSchedule Account

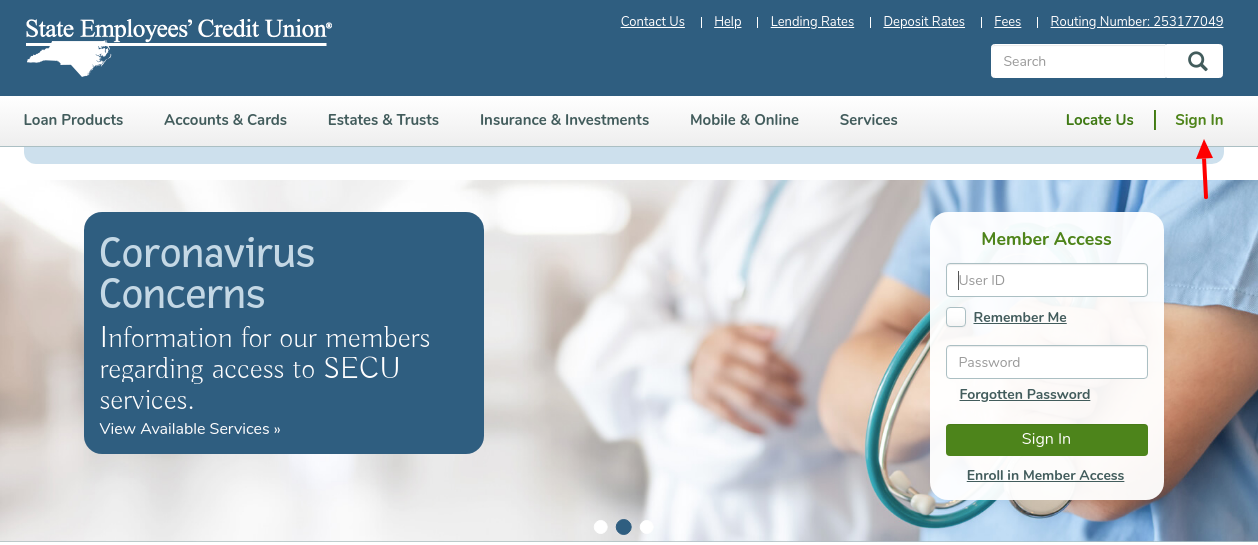

How to Login to NCSECU Member Online Account:

To log in to your SECU account you need to follow the below process.

- Open the official page of the NCSECU with the link www.ncsecu.org

- Now click on the “Sign In” option

- Enter your user id and password in the respective field

- Then click on the “Sign In” option

How to Access NCSECU Member Online Account with Mobile Phone:

To access your NCESCU member account with a mobile phone you need to follow the below process.

- Open the mobile login page with the link m.ncsecu.org

- Enter your user id and password then, click on the “Sign In” option

How to Reset the Password of NCSECU Member Online Account:

By following the below-mentioned process you can easily reset the forgotten password of your SECU account:

- At first, open the official website of the SECU with the link www.ncsecu.org

- Then click on the “Forgotten Password” option in the Sign-in section

- On the next page enter your user id and social security number

- Now click on the “Continue” option

How to Register for NCSECU Member Access:

To avail the conveniences of the SECU member online account you need to sign up first. The registration process contains the below steps.

- Open the official page of the NCSECU with the link www.ncsecu.org

- Click on the “Enroll in Member Access” option just below the login option

- On the next page click on the “Enroll Now” option

- Now enter your 16 digit ATM/Debit Card Number

- Then enter your 3 digit voice response number

- Go through the terms and conditions then, tick mark the option

- After that click on the “Continue” option

NCSECU Contact:

Call: (888)732-8562

Reference: